Back

Back  Next

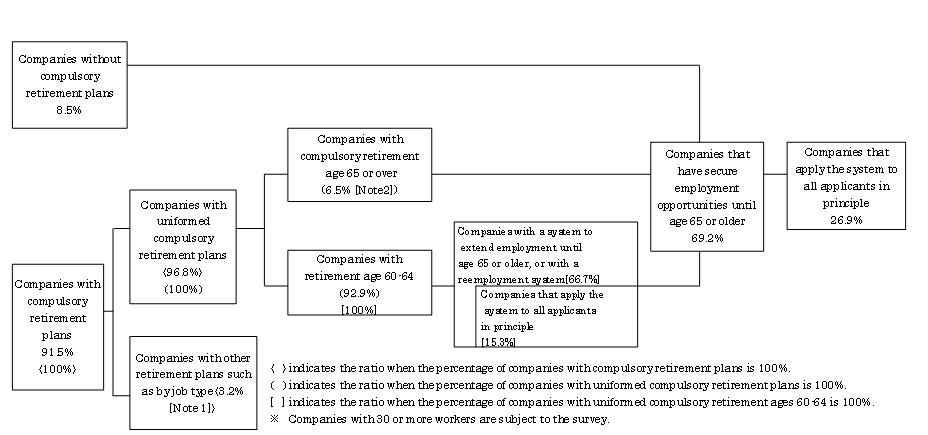

Next- The ratio of companies securing employment opportunities until age 65 or older is as high as 69.2% as of January 2004; however that of companies accepting all candidates for work up to the age of 65 is merely 26.9%. (Chart 2-3-1)

Chart 2-3-1. Ratios of Companies with Employment Security until Age 65

| Source: | Calculated from Ministry of Health, Labour and Welfare, "Employment Management Survey," 2004 |

| Note: | 1. There are a few companies ensuring employment until age 65 among companies with other retirement systems such as by job type. 2. There are also a few companies with a compulsory retirement age above 65. |

- In accordance with the rapidly aging population and declining birthrate, the "Law to Partially Amend the Law Concerning Stabilization of Employment of Older Persons (Law No. 103, 2004)" came into effect and was promulgated in June 2004. In order to enable the continuation of work at least up to the ages when pensions start to be paid, the Law obliged employers to take measures such as introducing the continuous employment system and gradually extending the retirement age up to 65 by 2013 in conjunction with the extension of the ages when pensions start to be paid for male workers.

- The Subsidy for Promoting the Settlement of Continued Employment has been provided for employers launching the continuous employment system or extending the retirement age. In addition, incentives have been given to employers who introduced and adopted the Short-hour Regular Employee System for the Elderly since FY 2004.

- Under the Law to Partially Amend the Law Concerning Stabilization of Employment of Older Persons, since December 2004, employers have been obliged to prepare and issue a document describing reemployment qualifications such as work history and job skills in addition to support measures for reemployment, upon the request of the older person who left the office due to dismissal.

- Under the Law to Partially Amend the Law Concerning Stabilization of Employment of Older Persons, Silver Human Resources Centers, upon application, have been allowed to be engaged in general worker dispatching undertakings related to temporary, short-time, or easy work since December 2004.

- In order to realize a society that allows the public in all age groups to work, since FY2004, the Japan Organization for Employment of the Elderly and Persons with Disabilities (JEED) has been conducting the Age-free Project aiming to develop an infrastructure needed to create such a society. In accordance with the project, JEED has been collecting and analyzing the good examples of systems for assisting older workers with recruitment, employment, and adjustment to a new office. In addition, by using the results of the analysis, JEED has been providing consulting/support services for individual companies and promoting awareness and familiarization among the public.

- In FY 2004, based on the "7th Basic Plan for Human Resources Development" (Plan Period: FY2001-2005) formulated in May 2001, the Prefectural Centers of the Employment and Human Resources Development Organization of Japan operated Career Development Support Corners. In addition, career counselors were fostered, and Career Development Promotion Grants were provided for employers supporting the career development of each worker.

- The "Bill for Partial Amendment to the Industrial Safety and Health Law, etc." was submitted to the 162nd Diet. The bill includes amendments to change the "Law concerning Temporary Measures for the Promotion of Shorter Working Hours" (Law No. 90, 1992) from the law promoting well-planned shorter working hours to the law promoting the improvement in setting working hours, rest days, and leaves that take into account the health conditions and lifestyle of each worker.

- In order to gain understanding from the public, especially from younger generation, the basic concept and importance of the public pension system have been widely diffused during Pension Week (November 6-12) and on other occasions. Additionally, in order to improve the payment rate for National Pension premiums, the payment of pension premiums at convenience stores was newly permitted, and the action plan containing annual objectives was formulated to steadily request defaulters to pay unpaid premiums.

- In order to establish sustainable, solid pension programs under the circumstances where the aging population and declining birthrate are accelerating rapidly, the Law to Partially Amend the National Pension Law, etc. (Law No. 104, 2004) came into force in June 2004. The Law is intended to 1) reduce the future rise of pension premium rates to the minimum level and fix the upper limit of the pension premium burden; 2) increase the percentage of national subsidies to total basic pensions; 3) utilize reserve funds; (iv) adjust the rate of benefits (growth in pension benefits) within the range of pension premium rates, thereby preventing the endless reduction of benefits to be paid.

- In principle, pension benefits are automatically revised in accordance with price fluctuation. However, as prices had gone down for three years since commodity prices fell in FY2000, pension benefits were left unchanged upon exceptional treatment. In a calculation according to the law, benefits in FY2003 should be decreased by 2.6%, adding the total for the past three years, but the revision was limited to the percentage decrease of the Price Index (-0.9%) in 2002.

In FY2004, pension benefits were also decreased upon exceptional treatment by the percentage decrease of the Price Index (-0.3%) in 2003.

Since the Price Index in 2004 remained unchanged from the previous year, pension benefits in FY2005 will not be revised and remain the same as in the previous year.

- The "Panel to Discuss Social Security," presided by the Chief Cabinet Secretary, was established in July 2004. The Panel commenced discussions to review the overall social security system including the unification of pensions provided in the public pension system, especially financial burden for taxes and pension premiums and the payment of benefits. In December 2004, the Panel put together the results of discussions made so far.

- Corporate pension plans were discussed along with the reforms of the public pension system. Under the Law to Partially Amend the National Pension Law, etc., the following amendments were made to stabilize and enhance corporate pension plans: 1) Lifting the freeze on the exempted premium rate of the Employees' Pension Fund; 2) Alleviating the limit of contribution for the defined contribution pension plan, and easing the requirement for redemption before maturity; 3) Improving convenient measures to add up each person's pension premiums related to different corporate pension plans of the defined-benefit type.

- In 2002, the Long-term Life Support Fund Loan System was established by the Prefectural Council of Social Welfare. This system allows elderly households with low income wishing to continue to live in their house to loan living expenses by mortgaging the house and the land on which the house is. As of December 31, 2004, 44 prefectures had already started lending activities, issuing loan permits for 232 cases.

- Information regarding the Adult Guardianship System to protect human rights of persons who need protection, including elderly people with dementia, is being widely provided. The system supports activities for the elderly, which includes such services as property management.

Top Page > Annual Report on the Aging Society > Annual Report:2005